Key Points:

- JPMorgan’s CEO cautions against Bitcoin, while the bank actively participates in BlackRock’s ETF.

- Uncover the paradox as traditional skepticism intersects with institutional participation in the evolving crypto landscape.

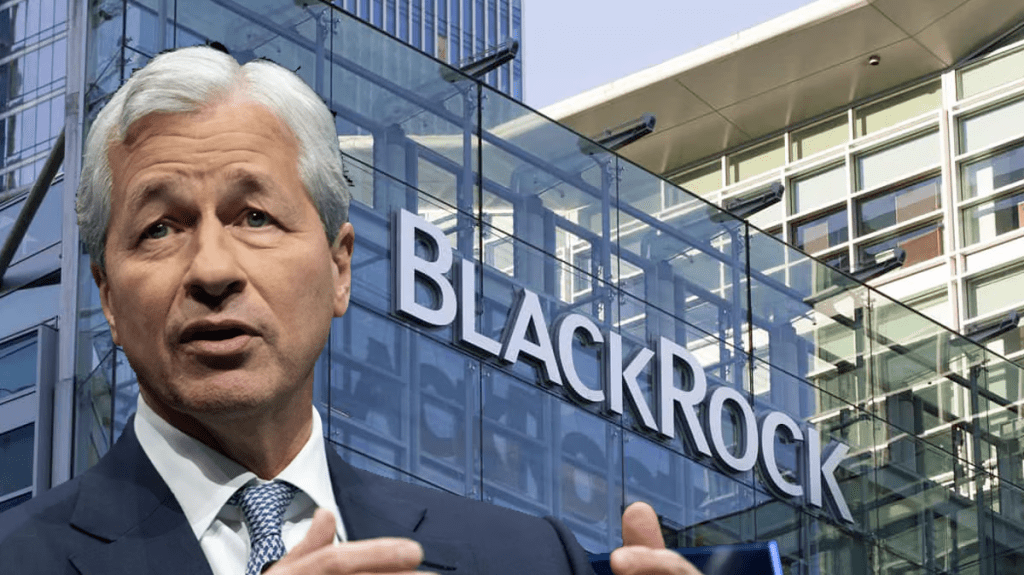

JPMorgan CEO Jamie Dimon has offered his “personal advice” cautioning against involvement with Bitcoin.

Dimon, a long-standing critic of the leading cryptocurrency, expressed skepticism about Bitcoin’s value and potential risks, emphasizing the volatile nature of the digital asset.

Dimon’s remarks come at a time when JPMorgan has taken on a pivotal role in the cryptocurrency space. Despite his reservations about Bitcoin, it is noteworthy that JPMorgan serves as an authorized participant for BlackRock’s ETF. This strategic position indicates the bank’s active engagement in facilitating the trading and creation of shares for BlackRock’s Bitcoin ETF.

While Dimon’s personal stance aligns with historical skepticism towards Bitcoin within traditional banking, JPMorgan’s involvement in BlackRock‘s Bitcoin ETF highlights the evolving dynamics in the financial landscape. The increasing institutional interest in Bitcoin, demonstrated by JPMorgan’s role in facilitating BlackRock’s ETF, underscores the growing recognition of digital assets within traditional financial institutions.

JPMorgan a Key Player in BlackRock’s Bitcoin ETF Landscape!

BlackRock’s spot Bitcoin ETF, with JPMorgan as an authorized participant, provides investors with a regulated and traditional means to gain exposure to Bitcoin. This development reflects the broader trend of institutional adoption of cryptocurrencies, as major players navigate the opportunities and challenges presented by the rapidly expanding digital asset market.

As Bitcoin continues to mature as an asset class, the contrasting views within financial institutions, such as Dimon’s cautionary advice and JPMorgan’s active role in the Bitcoin ETF space, offer a nuanced perspective on the cryptocurrency’s evolving status. Investors and industry observers will keenly watch how these dynamics unfold and influence the broader narrative surrounding Bitcoin and its integration into traditional financial markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |